PERSONAL LEVERAGE

Discover the strategic importance of leveraging your personal credit to fuel your startup business ambitions and lay a solid foundation for success. Explore how leveraging your personal resources can propel your entrepreneurial journey, secure funding, and create opportunities for business expansion. Uncover the essential role of leveraging assets in building a robust financial framework and driving sustainable growth in your business endeavors.

Credit is a financial tool that allows individuals to borrow funds for purchases or investments and pay back over time. Smart Wealth University emphasizes the importance of credit as it enables access to capital, builds financial credibility, and facilitates opportunities for growth and wealth creation.

The concept of having credit as a valuable financial asset was established by financial institutions and lenders to assess individuals’ creditworthiness and provide access to financial opportunities.

Credit is used in various financial transactions, including obtaining loans, mortgages, credit cards, and financing for purchases such as homes, cars, education, and businesses.

A credit score is calculated based on several factors, including payment history (35%), amount owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%). Lenders use this score to assess an individual’s creditworthiness and likelihood of repaying debts.

By understanding the power of personal leverage and the significance of credit in financial empowerment, you are equipped to make informed decisions that drive your entrepreneurial aspirations and financial success. Smart Wealth University is here to guide you on your journey to leveraging assets effectively, building a strong credit profile, and unlocking opportunities for growth and prosperity. Take charge of your financial future and embark on a path towards realizing your business goals with confidence and strategic leveraging. Join us at Smart Wealth University to elevate your personal leveraging options and create a legacy of success.

S&W Attorney's

Attorney Candace Sneed & Jeff Wilson practice in suing debt collectors, see if you qualify for a $1,000 debt violation today!

S&W can show you exactly what’s hurting your score

My Score

What Is My Score Based On

- 35% Payment History

Payment History: how late, how much owed, and how recent. 60 days late does not have as much impact as 90 days late.

How recent and frequent count: 60 days late a month ago will have more impact than a 90 day late payment 5 years ago

Postive payment history: on most of your accounts will increase score! - 30% Amounts Owed

Amounts Owed: when high percentage of a consumer’s credit has been used up, this indicates a consumer may be overextended and more of a credit risk, which affects credit scoring

Revolving vs. Installment Debt: too much revolving may mean having trouble making future payments - 15% Length of Credit Used

Length of Credit History: the longer established credit history will raise credit score versus history of a short period. Long established accounts show longer history of managing credit wisely

Age of Credit Accounts: score influenced by age of your oldest account, age of your newest account and average age of all your accounts - 10% New Credit

New Credit: research shows opening several credit accounts in a short time frame does represent greater risk to a lender as

Several Credit Inquires: people w/6 inquiries or more can be up to 8Xs more likely to declare bankruptcy than those w/no inquiries - 10%Types of Credit Used

Types of Credit: score based on mix of credit cards, retail, finance company accounts, mortgage and installment loans

Credit Time Line

- Updated every 30 days

- Positive Info: Indefinitely

- Bankruptcies: 7 – 10 years

- Public Records: 7 years

- Inquiries: 2 years

- Inactive/closed: Cycle off

What Lowers My Score

- Late Payments

- Maxed out credit cards (low capacity)

- Closing Credit Accounts

- Collection Items

- More Revolving Debt vs. Installment Debt

- Bankruptcy

- New Accounts

- Several Credit Inquiries

- Sub Prime Lenders

Awareness

My Credit Score

“Numerical value between 300-850 Number that sums up your credit report and risk to a lender. The higher the credit score, the less risk Less risk = best loan terms and interest rates.

US Average Credit Breakdown

1% 499 and below

5% 500-549

7% 550-599

11% 600-649

16% 650-699

20% 700-749

29% 749-799

11% 800 and above

What's On My Report

OFAC, Credit Score Identification: name, address, SSN, birth date, employment. Public Records: bankruptcy, tax liens, garnishments Foreclosures, lawsuits and judgments. Collection Items: unpaid bills turned for collection. Credit History: past credit accounts to most recent, with current balances, monthly payments, payment history, date opened or closed, original loan amount, credit limit. Credit Inquiries: past 24 month period, voluntary and involuntary

How to Raise or Maintain a Credit Score?

Making payments on time.

Removing negative info.

Paying down/off credit cards (raises capacity).

Using oldest credit card.

Open new accounts slowly.

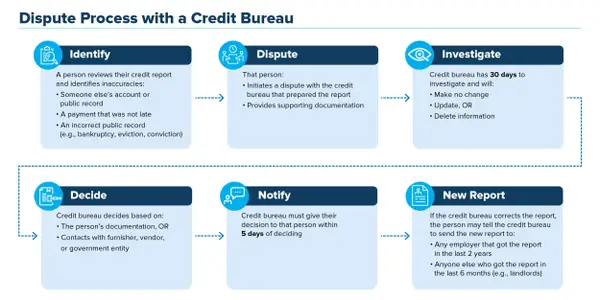

Correct credit report errors.

Paid collection items.

Mortgage, secured loans and installment loans with positive payment history.

Open Credit Lines vs. Credit Card Limits.

Stable bio.

Know Your Credit Bureaus

Company that collects consumer financial info Sells it in the form of credit reports Assigns score based on credit behavior history Maintains lifetime records of millions of consumers’ credit history.

S&W

We have years of experience helping clients meeting their financial goals

SMART APPROACH

We use proven finance strategies designed to meet your risk tolerance and stand up against market volatility. And you can count on unbiased recommendations and impartial guidance based directly on your needs and goals.

MISSION

Every successful financial strategy starts with an excellent client relationship and our mission and values include exceeding our client’s every expectation.